CoinChef

CHEFC

attach_money

Son Fiyat

0.00037512$

horizontal_rule

Günlük Değişim

0.00%

shopping_bag

Piyasa Değeri

375.12 Bin

CoinChef Yorumu

**CHEFC Coin Analizi ve Piyasa Görünümü**

Son günlerde kripto para piyasalarında genel bir istikrarsızlık gözlemleniyor. Major coin'lerdeki dalgalanmalar, yatırımcıların risk iştahını etkiliyor. CHEFC coin de bu genel trendden nasibini alarak, son haftalarda volatil bir hareket içinde. Kısa vadeli beklentiler, coin'in önemli destek ve direnç seviyelerinde nasıl bir performans göstereceğine bağlı olarak değişebilir.

CHEFC coin'in teknik analizi, several key indicators and levels. The 50 and 200-day moving averages (EMA) are currently in a bearish crossover, indicating potential short-term weakness. The Relative Strength Index (RSI) is hovering around 45, suggesting that the coin is not in an overbought or oversold condition. The MACD indicator shows a bearish signal line crossover, which could imply further downward pressure.

Volume analysis reveals moderate trading activity, with the 24-hour volume remaining stable but not showing significant growth. This suggests that the market is still undecided about the coin's future direction. The Bollinger Bands are narrowing slightly, indicating a potential breakout or breakdown in the near future.

The key support levels for CHEFC are currently at $0.045 and $0.038. These levels have historically acted as strong support zones, and a break below $0.038 could lead to further declines. On the resistance side, the critical levels are at $0.055 and $0.062. A breakout above $0.062 could signal a bullish reversal and open the door to higher levels.

The EMA (50, 200) crossover is bearish, and the RSI is neutral. The MACD is bearish, and the Bollinger Bands are narrowing. Volume is stable but not increasing significantly. These indicators collectively suggest that CHEFC is in a consolidation phase, waiting for a catalyst to move in either direction.

In the short term, CHEFC coin seems to be facing downward pressure due to bearish technical indicators. However, the support levels at $0.045 and $0.038 are crucial, and if these hold, a recovery could be possible. Long-term investors should consider the overall market sentiment and macroeconomic factors before making any decisions.

Investors are advised to keep a close eye on the volume and price action around the key support and resistance levels. Risk management is essential in such volatile markets, and setting stop-loss orders is recommended. For the latest updates and daily crypto analysis, follow us regularly.

Son günlerde kripto para piyasalarında genel bir istikrarsızlık gözlemleniyor. Major coin'lerdeki dalgalanmalar, yatırımcıların risk iştahını etkiliyor. CHEFC coin de bu genel trendden nasibini alarak, son haftalarda volatil bir hareket içinde. Kısa vadeli beklentiler, coin'in önemli destek ve direnç seviyelerinde nasıl bir performans göstereceğine bağlı olarak değişebilir.

**Piyasa Analizi**

CHEFC coin'in teknik analizi, several key indicators and levels. The 50 and 200-day moving averages (EMA) are currently in a bearish crossover, indicating potential short-term weakness. The Relative Strength Index (RSI) is hovering around 45, suggesting that the coin is not in an overbought or oversold condition. The MACD indicator shows a bearish signal line crossover, which could imply further downward pressure.

Volume analysis reveals moderate trading activity, with the 24-hour volume remaining stable but not showing significant growth. This suggests that the market is still undecided about the coin's future direction. The Bollinger Bands are narrowing slightly, indicating a potential breakout or breakdown in the near future.

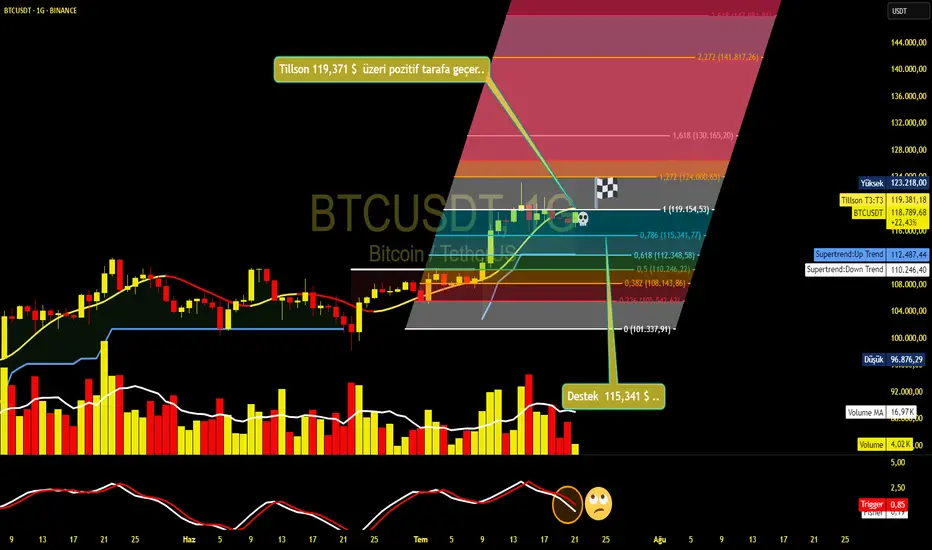

**Destek ve Direnç Seviyeleri**

The key support levels for CHEFC are currently at $0.045 and $0.038. These levels have historically acted as strong support zones, and a break below $0.038 could lead to further declines. On the resistance side, the critical levels are at $0.055 and $0.062. A breakout above $0.062 could signal a bullish reversal and open the door to higher levels.

**Teknik Göstergeler**

The EMA (50, 200) crossover is bearish, and the RSI is neutral. The MACD is bearish, and the Bollinger Bands are narrowing. Volume is stable but not increasing significantly. These indicators collectively suggest that CHEFC is in a consolidation phase, waiting for a catalyst to move in either direction.

**Sonuç ve Öneriler**

In the short term, CHEFC coin seems to be facing downward pressure due to bearish technical indicators. However, the support levels at $0.045 and $0.038 are crucial, and if these hold, a recovery could be possible. Long-term investors should consider the overall market sentiment and macroeconomic factors before making any decisions.

Investors are advised to keep a close eye on the volume and price action around the key support and resistance levels. Risk management is essential in such volatile markets, and setting stop-loss orders is recommended. For the latest updates and daily crypto analysis, follow us regularly.

Otomatik İşlem

Otomatik İşlem