PENTA TEKNOLOJI URUNLERI DAGITIM

PENTA

attach_money

Son Fiyat

16.06₺

trending_up

Günlük Değişim

2.42%

shopping_bag

Piyasa Değeri

6.32 Milyar

PENTA TEKNOLOJI URUNLERI DAGITIM Yorumu

Let's dive into the technical analysis of PENTA (PENTA TEKNOLOJİ ÜRÜNLERİ DAĞITIM TİCARET A.Ş.) based on the provided data.

**Technical Overview**

PENTA is currently trading at 16.059999, with a 2.42% increase in the last session. The relative strength index (RSI) is at 71.786745, indicating a slightly overbought situation. The stochastic oscillator's %K is at 85.47, while %D is at 80.15, suggesting a bullish momentum.

**Volume Analysis**

The volume is relatively low, with a relative volume of 0.9823588018738858. This could indicate a lack of conviction from investors, and the price action might be vulnerable to sudden changes.

**Price Action**

PENTA is currently trading above its 50-day moving average, which is a bullish sign. However, the price is also getting close to the upper resistance zone, where selling pressure might increase.

**Pivot Points**

The pivot point (M) is at 15.03, while resistance levels are at 16.021916 (R1), 16.363833 (R2), and 16.705749 (R3). Support levels are at 15.338083 (S1), 14.996166 (S2), and 14.654249 (S3).

**Trend Analysis**

The technical rating is "AL" (Alış), indicating a strong buying signal. The 50-day moving average is trending upwards, and the price is above it, which reinforces the bullish sentiment.

**RSI and Stochastic Oscillator**

The RSI is near the overbought zone, which could lead to a correction. However, the stochastic oscillator's %K is above %D, indicating a continued upward momentum.

**Outlook**

Based on the analysis, I would expect PENTA to continue its upward trend in the short term. However, the RSI's overbought situation and the proximity to the upper resistance zone suggest that a correction might be imminent. I would recommend buying on dips, targeting the 16.363833 (R2) level, and trailing stops to lock in profits.

**Support and Resistance**

Buy on dips near 15.338083 (S1) and 14.996166 (S2). Set stop-losses below 14.654249 (S3). Resistance levels are at 16.021916 (R1), 16.363833 (R2), and 16.705749 (R3).

In conclusion, PENTA is bullish in the short term, but investors should be cautious of a potential correction due to the RSI's overbought situation. Buying on dips and trailing stops could be an effective strategy to capitalize on the upward trend.

Please note that this analysis is for informational purposes only and should not be considered as investment advice. Always do your own research and consult with a financial advisor before making any investment decisions.

**Technical Overview**

PENTA is currently trading at 16.059999, with a 2.42% increase in the last session. The relative strength index (RSI) is at 71.786745, indicating a slightly overbought situation. The stochastic oscillator's %K is at 85.47, while %D is at 80.15, suggesting a bullish momentum.

**Volume Analysis**

The volume is relatively low, with a relative volume of 0.9823588018738858. This could indicate a lack of conviction from investors, and the price action might be vulnerable to sudden changes.

**Price Action**

PENTA is currently trading above its 50-day moving average, which is a bullish sign. However, the price is also getting close to the upper resistance zone, where selling pressure might increase.

**Pivot Points**

The pivot point (M) is at 15.03, while resistance levels are at 16.021916 (R1), 16.363833 (R2), and 16.705749 (R3). Support levels are at 15.338083 (S1), 14.996166 (S2), and 14.654249 (S3).

**Trend Analysis**

The technical rating is "AL" (Alış), indicating a strong buying signal. The 50-day moving average is trending upwards, and the price is above it, which reinforces the bullish sentiment.

**RSI and Stochastic Oscillator**

The RSI is near the overbought zone, which could lead to a correction. However, the stochastic oscillator's %K is above %D, indicating a continued upward momentum.

**Outlook**

Based on the analysis, I would expect PENTA to continue its upward trend in the short term. However, the RSI's overbought situation and the proximity to the upper resistance zone suggest that a correction might be imminent. I would recommend buying on dips, targeting the 16.363833 (R2) level, and trailing stops to lock in profits.

**Support and Resistance**

Buy on dips near 15.338083 (S1) and 14.996166 (S2). Set stop-losses below 14.654249 (S3). Resistance levels are at 16.021916 (R1), 16.363833 (R2), and 16.705749 (R3).

In conclusion, PENTA is bullish in the short term, but investors should be cautious of a potential correction due to the RSI's overbought situation. Buying on dips and trailing stops could be an effective strategy to capitalize on the upward trend.

Please note that this analysis is for informational purposes only and should not be considered as investment advice. Always do your own research and consult with a financial advisor before making any investment decisions.

Fikirler

Benzer Hisseler

|

SELCUK ECZA DEPOSU (SELEC)

Son Fiyat - 96.65₺

|

arrow_forward |

|

GRAINTURK HOLDING (GRTHO)

Son Fiyat - 457.75₺

|

arrow_forward |

|

LYDIA HOLDING (LYDHO)

Son Fiyat - 132.00₺

|

arrow_forward |

|

INGRAM MICRO BILISIM SISTEMLERI AS (INGRM)

Son Fiyat - 406.00₺

|

arrow_forward |

|

INDEKS BILGISAYAR (INDES)

Son Fiyat - 7.58₺

|

arrow_forward |

|

PENTA TEKNOLOJI URUNLERI DAGITIM (PENTA)

Son Fiyat - 16.06₺

|

arrow_forward |

|

ARENA BILGISAYAR (ARENA)

Son Fiyat - 40.98₺

|

arrow_forward |

|

AZTEK TEKNOLOJI (AZTEK)

Son Fiyat - 43.90₺

|

arrow_forward |

|

MOBILTEL ILETISIM (MOBTL)

Son Fiyat - 7.72₺

|

arrow_forward |

|

YATAS YATAK VE YORGAN (YATAS)

Son Fiyat - 28.04₺

|

arrow_forward |

|

DATAGATE BILGISAYAR (DGATE)

Son Fiyat - 75.70₺

|

arrow_forward |

|

YUKSELEN CELIK (YKSLN)

Son Fiyat - 6.72₺

|

arrow_forward |

|

DESPEC BILGISAYAR (DESPC)

Son Fiyat - 51.25₺

|

arrow_forward |

|

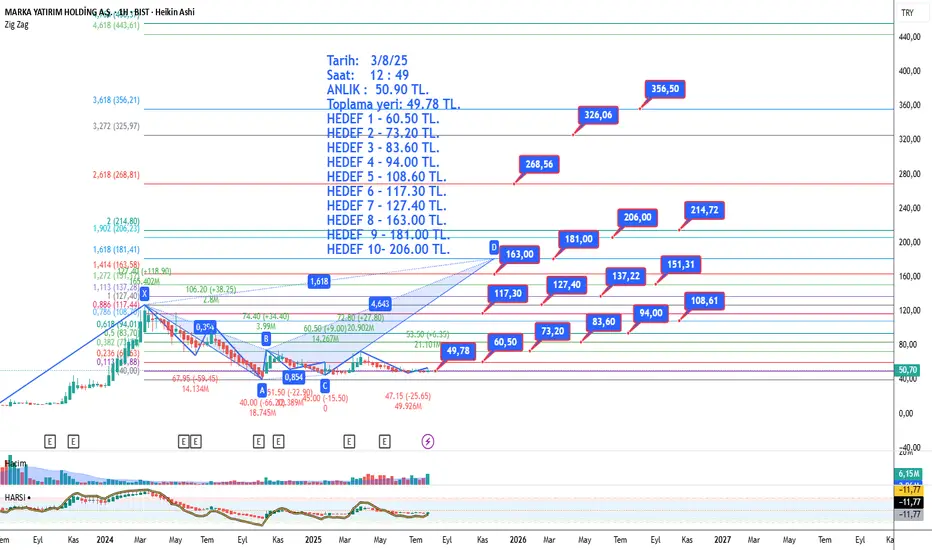

MARKA YATIRIM HOLDING (MARKA)

Son Fiyat - 50.70₺

|

arrow_forward |

|

ARZUM EV ALETLERI (ARZUM)

Son Fiyat - 5.11₺

|

arrow_forward |

|

TGS DIS TICARET (TGSAS)

Son Fiyat - 146.10₺

|

arrow_forward |

|

COSMOS YAT. HOLDING (COSMO)

Son Fiyat - 123.00₺

|

arrow_forward |

|

VANET GIDA (VANGD)

Son Fiyat - 46.84₺

|

arrow_forward |

|

CASA EMTIA PETROL (CASA)

Son Fiyat - 113.00₺

|

arrow_forward |

|

DCT TRADING DIS TICARET (DCTTR)

Son Fiyat - 36.92₺

|

arrow_forward |

Hisse Sinyalleri

Hisse Sinyalleri