GENTAS

GENTS

attach_money

Son Fiyat

23.86₺

trending_up

Günlük Değişim

0.17%

shopping_bag

Piyasa Değeri

6.87 Milyar

GENTAS Yorumu

The art of technical analysis! Let's dive into the world of charts and numbers, and uncover the hidden secrets of BIST:GENTS.

As I gaze upon the candles, I notice a slight upward trend, with a 0.1679261125104918% increase in the last period. The relative strength index (RSI) sits at 46.36706843979268, indicating a neutral zone, neither overbought nor oversold. The stochastics K and D lines dance in harmony, with K at 13.2596685082873 and D at 10.83508479436222, hinting at a potential bullish crossover.

Now, let's talk about the volume. The relative volume is 1.2589991381597069, a relatively high value compared to the average. This tells me that the market is willing to participate in the price action, and we might see a continuation of the trend.

The price-to-earnings ratio stands at 73.6192533168775, a relatively high value, indicating that the market is willing to pay a premium for each unit of earnings. However, the seyreltilmiş EPS growth rate is -30.075512405609494%, a concerning sign that might indicate a potential slowdown in earnings growth.

The pivot points are the real showstoppers here. The pivot median is 24.713333333333334, with R1, R2, and R3 at 24.157333333333333, 24.494666666666667, and 24.832000000000000, respectively. On the flip side, we have S1, S2, and S3 at 23.482666666666666, 23.145333333333333, and 22.807999999999999. These levels will act as crucial resistance and support zones for our analysis.

The boğa ayı growth rate is -1.0176954845445856, a bearish sign that might indicate a potential reversal in the trend. However, I won't jump to conclusions just yet. The technical rating is a "sat" or sell, but I'll need to dig deeper to uncover the underlying reasons behind this rating.

In conclusion, I foresee a potential struggle between the bulls and bears in the short term. The RSI is neutral, and the stochastics are hinting at a bullish crossover, but the pivot points suggest a strong resistance zone above 24.832. I'd recommend a cautious approach, with a potential short-term target at 23.482, and a stop-loss at 24.494.

Remember, the market is a complex beast, and only time will tell which direction it will take. As your trusted trader professor, I'll keep a close eye on these charts and adjust my analysis accordingly. Stay tuned for further updates!

As I gaze upon the candles, I notice a slight upward trend, with a 0.1679261125104918% increase in the last period. The relative strength index (RSI) sits at 46.36706843979268, indicating a neutral zone, neither overbought nor oversold. The stochastics K and D lines dance in harmony, with K at 13.2596685082873 and D at 10.83508479436222, hinting at a potential bullish crossover.

Now, let's talk about the volume. The relative volume is 1.2589991381597069, a relatively high value compared to the average. This tells me that the market is willing to participate in the price action, and we might see a continuation of the trend.

The price-to-earnings ratio stands at 73.6192533168775, a relatively high value, indicating that the market is willing to pay a premium for each unit of earnings. However, the seyreltilmiş EPS growth rate is -30.075512405609494%, a concerning sign that might indicate a potential slowdown in earnings growth.

The pivot points are the real showstoppers here. The pivot median is 24.713333333333334, with R1, R2, and R3 at 24.157333333333333, 24.494666666666667, and 24.832000000000000, respectively. On the flip side, we have S1, S2, and S3 at 23.482666666666666, 23.145333333333333, and 22.807999999999999. These levels will act as crucial resistance and support zones for our analysis.

The boğa ayı growth rate is -1.0176954845445856, a bearish sign that might indicate a potential reversal in the trend. However, I won't jump to conclusions just yet. The technical rating is a "sat" or sell, but I'll need to dig deeper to uncover the underlying reasons behind this rating.

In conclusion, I foresee a potential struggle between the bulls and bears in the short term. The RSI is neutral, and the stochastics are hinting at a bullish crossover, but the pivot points suggest a strong resistance zone above 24.832. I'd recommend a cautious approach, with a potential short-term target at 23.482, and a stop-loss at 24.494.

Remember, the market is a complex beast, and only time will tell which direction it will take. As your trusted trader professor, I'll keep a close eye on these charts and adjust my analysis accordingly. Stay tuned for further updates!

Fikirler

Benzer Hisseler

|

ASTOR ENERJI (ASTOR)

Son Fiyat - 104.50₺

|

arrow_forward |

|

TURK TRAKTOR (TTRAK)

Son Fiyat - 594.50₺

|

arrow_forward |

|

KALYON GUNES TEKNOLOJILERI (KLYPV)

Son Fiyat - 70.40₺

|

arrow_forward |

|

EGE ENDUSTRI (EGEEN)

Son Fiyat - 7947.50₺

|

arrow_forward |

|

EUROPOWER ENERJI (EUPWR)

Son Fiyat - 31.20₺

|

arrow_forward |

|

BOSCH FREN SISTEMLERI (BFREN)

Son Fiyat - 175.00₺

|

arrow_forward |

|

KALESERAMIK (KLSER)

Son Fiyat - 34.92₺

|

arrow_forward |

|

JANTSA JANT SANAYI (JANTS)

Son Fiyat - 22.30₺

|

arrow_forward |

|

TUMOSAN MOTOR VE TRAKTOR (TMSN)

Son Fiyat - 123.60₺

|

arrow_forward |

|

ULUSOY ELEKTRIK (ULUSE)

Son Fiyat - 215.10₺

|

arrow_forward |

|

BERA HOLDING (BERA)

Son Fiyat - 16.53₺

|

arrow_forward |

|

SARKUYSAN (SARKY)

Son Fiyat - 19.90₺

|

arrow_forward |

|

ALARKO CARRIER (ALCAR)

Son Fiyat - 999.50₺

|

arrow_forward |

|

KARSAN OTOMOTIV (KARSN)

Son Fiyat - 10.07₺

|

arrow_forward |

|

HATSAN GEMI (HATSN)

Son Fiyat - 44.46₺

|

arrow_forward |

|

BMS BIRLESIK METAL (BMSTL)

Son Fiyat - 57.35₺

|

arrow_forward |

|

EUROPEN ENDUSTRI (EUREN)

Son Fiyat - 7.10₺

|

arrow_forward |

|

KIMTEKS POLIURETAN (KMPUR)

Son Fiyat - 15.79₺

|

arrow_forward |

|

YIGIT AKU (YIGIT)

Son Fiyat - 25.70₺

|

arrow_forward |

|

KUZEY BORU (KBORU)

Son Fiyat - 12.94₺

|

arrow_forward |

|

GIPTA OFIS KIRTASIYE (GIPTA)

Son Fiyat - 122.00₺

|

arrow_forward |

|

OZATA DENIZCILIK (OZATD)

Son Fiyat - 231.00₺

|

arrow_forward |

|

DOKTAS DOKUMCULUK (DOKTA)

Son Fiyat - 24.36₺

|

arrow_forward |

|

TURK PRYSMIAN KABLO (PRKAB)

Son Fiyat - 34.72₺

|

arrow_forward |

|

KIRAC GALVANIZ (TCKRC)

Son Fiyat - 47.08₺

|

arrow_forward |

|

PARSAN (PARSN)

Son Fiyat - 92.15₺

|

arrow_forward |

|

EKOS TEKNOLOJI (EKOS)

Son Fiyat - 22.02₺

|

arrow_forward |

|

ALVES KABLO (ALVES)

Son Fiyat - 29.30₺

|

arrow_forward |

|

ISIK PLASTIK (ISKPL)

Son Fiyat - 37.30₺

|

arrow_forward |

|

F-M IZMIT PISTON (FMIZP)

Son Fiyat - 312.50₺

|

arrow_forward |

|

IZMIR FIRCA (IZFAS)

Son Fiyat - 185.00₺

|

arrow_forward |

|

BULBULOGLU VINC (BVSAN)

Son Fiyat - 103.00₺

|

arrow_forward |

|

INTEMA (INTEM)

Son Fiyat - 202.20₺

|

arrow_forward |

|

GENTAS (GENTS)

Son Fiyat - 23.86₺

|

arrow_forward |

|

SANICA ISI SANAYI (SNICA)

Son Fiyat - 4.66₺

|

arrow_forward |

|

SAY YENILENEBILIR ENERJI (SAYAS)

Son Fiyat - 57.00₺

|

arrow_forward |

|

USAK SERAMIK (USAK)

Son Fiyat - 4.84₺

|

arrow_forward |

|

MEKA GLOBAL MAKINE (MEKAG)

Son Fiyat - 47.42₺

|

arrow_forward |

|

EGE SERAMIK (EGSER)

Son Fiyat - 3.62₺

|

arrow_forward |

|

EMEK ELEKTRIK (EMKEL)

Son Fiyat - 83.10₺

|

arrow_forward |

|

SAFKAR EGE SOGUTMACILIK (SAFKR)

Son Fiyat - 110.20₺

|

arrow_forward |

|

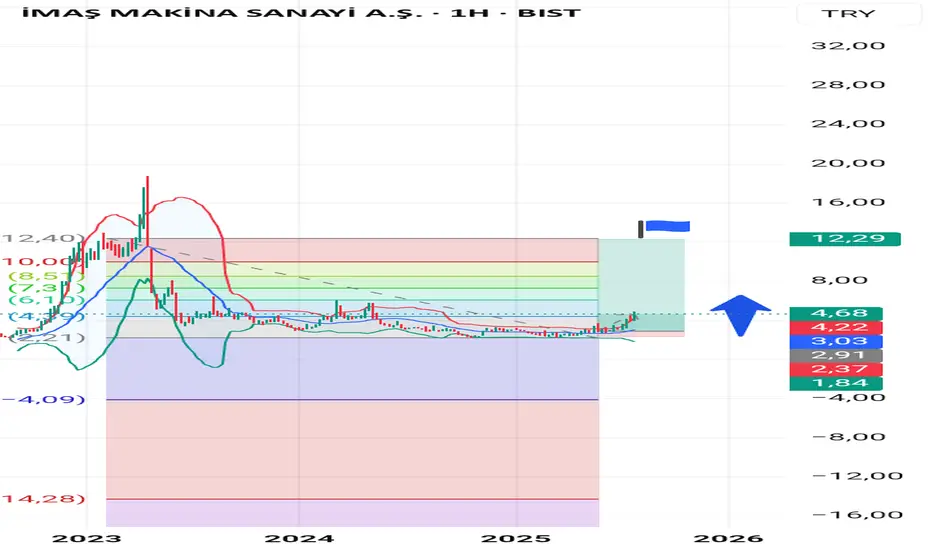

IMAS MAKINA (IMASM)

Son Fiyat - 4.68₺

|

arrow_forward |

|

KATMERCILER EKIPMAN (KATMR)

Son Fiyat - 2.70₺

|

arrow_forward |

|

GERSAN ELEKTRIK (GEREL)

Son Fiyat - 23.12₺

|

arrow_forward |

|

KLIMASAN KLIMA (KLMSN)

Son Fiyat - 26.94₺

|

arrow_forward |

|

HIDROPAR HAREKET KONTROL (HKTM)

Son Fiyat - 11.97₺

|

arrow_forward |

|

MANAS ENERJI YONETIMI (MANAS)

Son Fiyat - 10.83₺

|

arrow_forward |

|

AYES CELIK HASIR VE CIT (AYES)

Son Fiyat - 18.00₺

|

arrow_forward |

|

DEMISAS DOKUM (DMSAS)

Son Fiyat - 7.62₺

|

arrow_forward |

|

MAKINA TAKIM (MAKTK)

Son Fiyat - 17.59₺

|

arrow_forward |

|

DITAS DOGAN (DITAS)

Son Fiyat - 31.06₺

|

arrow_forward |

|

BMS CELIK HASIR (BMSCH)

Son Fiyat - 14.10₺

|

arrow_forward |

|

EGEPLAST (EPLAS)

Son Fiyat - 6.55₺

|

arrow_forward |

|

SILVERLINE ENDUSTRI (SILVR)

Son Fiyat - 23.96₺

|

arrow_forward |

|

BALATACILAR BALATACILIK (BALAT)

Son Fiyat - 67.50₺

|

arrow_forward |

|

BURCELIK VANA (BURVA)

Son Fiyat - 105.50₺

|

arrow_forward |

|

RAINBOW POLIKARBONAT (RNPOL)

Son Fiyat - 34.18₺

|

arrow_forward |

|

MAZHAR ZORLU HOLDING (MZHLD)

Son Fiyat - 6.69₺

|

arrow_forward |

|

SANEL MUHENDISLIK (SANEL)

Son Fiyat - 28.66₺

|

arrow_forward |

|

SERANIT GRANIT SERAMIK (SERNT)

Son Fiyat - 10.13₺

|

arrow_forward |

|

OZYASAR TEL (OZYSR)

Son Fiyat - 30.54₺

|

arrow_forward |

Hisse Sinyalleri

Hisse Sinyalleri