ISBIR HOLDING

ISBIR

attach_money

Son Fiyat

114.90₺

trending_down

Günlük Değişim

-0.09%

shopping_bag

Piyasa Değeri

2.99 Milyar

ISBIR HOLDING Yorumu

Dear fellow traders, today we're going to dive deep into the technical analysis of ISBIR, a stock that's been making waves in the market lately. With the data provided, we'll explore the key indicators, trends, and levels that will help us make an informed decision about this stock's future direction.

First off, let's take a look at the stock's current price, which stands at 114.9. The daily percentage change is -0.087%, which might seem insignificant, but trust me, it's a crucial piece of information. The relative volume is 0.6688, indicating a moderate trading activity, which is essential for our analysis.

Now, let's talk about the stock's technical rating, which is "AL" - a clear buy signal. The RSI (Relative Strength Index) stands at 73.28, indicating that the stock is not yet overbought, but it's getting close. This is a warning sign that we need to be cautious and monitor the stock's movement closely.

The Stochastic Oscillator, another vital indicator, shows that the stock is in the overbought region, with a K-line of 94.24 and a D-line of 94.86. This is a strong signal that the stock might experience a pullback or consolidation phase in the near future.

Now, let's examine the key levels that will determine the stock's direction. The pivot point (M) is at 105.98, which is a critical support level. If the stock breaks below this level, we might see a significant correction. On the other hand, if the stock manages to stay above this level, we could see a continuation of the uptrend.

The resistance levels are also crucial, with R1 at 117.66, R2 at 120.33, and R3 at 122.99. If the stock breaks above R1, we could see a significant rally, but if it fails to break above R2, it might indicate a reversal.

Lastly, let's take a look at the support levels, which are S1 at 112.34, S2 at 109.67, and S3 at 107.01. If the stock breaks below S1, we might see a correction, but if it breaks below S2, it could signal a more significant downturn.

In conclusion, based on the technical analysis, I believe that ISBIR is in a delicate position. While the technical rating is a buy signal, the RSI and Stochastic Oscillator are warning signs that the stock might experience a pullback. The pivot point and support levels will be crucial in determining the stock's direction, and I would recommend caution and close monitoring of the stock's movement.

As a seasoned trader, I would not recommend buying at the current price, but rather wait for a correction or a clear breakout above R1. The risk-reward ratio is not in our favor, and we need to be patient and disciplined in our trading decisions.

Remember, dear traders, technical analysis is not a guarantee of success, but it's a tool that can help us make informed decisions. Always do your own research, and never invest more than you can afford to lose. Happy trading!

First off, let's take a look at the stock's current price, which stands at 114.9. The daily percentage change is -0.087%, which might seem insignificant, but trust me, it's a crucial piece of information. The relative volume is 0.6688, indicating a moderate trading activity, which is essential for our analysis.

Now, let's talk about the stock's technical rating, which is "AL" - a clear buy signal. The RSI (Relative Strength Index) stands at 73.28, indicating that the stock is not yet overbought, but it's getting close. This is a warning sign that we need to be cautious and monitor the stock's movement closely.

The Stochastic Oscillator, another vital indicator, shows that the stock is in the overbought region, with a K-line of 94.24 and a D-line of 94.86. This is a strong signal that the stock might experience a pullback or consolidation phase in the near future.

Now, let's examine the key levels that will determine the stock's direction. The pivot point (M) is at 105.98, which is a critical support level. If the stock breaks below this level, we might see a significant correction. On the other hand, if the stock manages to stay above this level, we could see a continuation of the uptrend.

The resistance levels are also crucial, with R1 at 117.66, R2 at 120.33, and R3 at 122.99. If the stock breaks above R1, we could see a significant rally, but if it fails to break above R2, it might indicate a reversal.

Lastly, let's take a look at the support levels, which are S1 at 112.34, S2 at 109.67, and S3 at 107.01. If the stock breaks below S1, we might see a correction, but if it breaks below S2, it could signal a more significant downturn.

In conclusion, based on the technical analysis, I believe that ISBIR is in a delicate position. While the technical rating is a buy signal, the RSI and Stochastic Oscillator are warning signs that the stock might experience a pullback. The pivot point and support levels will be crucial in determining the stock's direction, and I would recommend caution and close monitoring of the stock's movement.

As a seasoned trader, I would not recommend buying at the current price, but rather wait for a correction or a clear breakout above R1. The risk-reward ratio is not in our favor, and we need to be patient and disciplined in our trading decisions.

Remember, dear traders, technical analysis is not a guarantee of success, but it's a tool that can help us make informed decisions. Always do your own research, and never invest more than you can afford to lose. Happy trading!

Fikirler

Benzer Hisseler

|

SASA POLYESTER (SASA)

Son Fiyat - 3.12₺

|

arrow_forward |

|

GUBRE FABRIK. (GUBRF)

Son Fiyat - 255.00₺

|

arrow_forward |

|

AKSA AKRILIK (AKSA)

Son Fiyat - 10.12₺

|

arrow_forward |

|

PETKIM (PETKM)

Son Fiyat - 17.27₺

|

arrow_forward |

|

HEKTAS (HEKTS)

Son Fiyat - 4.05₺

|

arrow_forward |

|

BANVIT (BANVT)

Son Fiyat - 226.20₺

|

arrow_forward |

|

POLITEKNIK METAL (POLTK)

Son Fiyat - 6707.50₺

|

arrow_forward |

|

MARSHALL (MRSHL)

Son Fiyat - 1463.00₺

|

arrow_forward |

|

KALEKIM KIMYEVI MADDELER (KLKIM)

Son Fiyat - 28.78₺

|

arrow_forward |

|

EGE PROFIL (EGPRO)

Son Fiyat - 21.74₺

|

arrow_forward |

|

KORDSA TEKNIK TEKSTIL (KORDS)

Son Fiyat - 61.30₺

|

arrow_forward |

|

YAPRAK SUT VE BESI CIFT. (YAPRK)

Son Fiyat - 342.25₺

|

arrow_forward |

|

YAYLA GIDA (YYLGD)

Son Fiyat - 10.72₺

|

arrow_forward |

|

POLISAN HOLDING (POLHO)

Son Fiyat - 4.09₺

|

arrow_forward |

|

BOSSA (BOSSA)

Son Fiyat - 6.87₺

|

arrow_forward |

|

KARTONSAN (KARTN)

Son Fiyat - 90.45₺

|

arrow_forward |

|

DYO BOYA (DYOBY)

Son Fiyat - 15.81₺

|

arrow_forward |

|

SANIFOAM ENDUSTRI (SANFM)

Son Fiyat - 20.50₺

|

arrow_forward |

|

TARKIM BITKI KORUMA (TARKM)

Son Fiyat - 377.00₺

|

arrow_forward |

|

SONMEZ PAMUKLU (SNPAM)

Son Fiyat - 34.06₺

|

arrow_forward |

|

KOZA POLYESTER (KOPOL)

Son Fiyat - 5.76₺

|

arrow_forward |

|

EGE GUBRE (EGGUB)

Son Fiyat - 101.90₺

|

arrow_forward |

|

MONDI TURKEY (MNDTR)

Son Fiyat - 6.54₺

|

arrow_forward |

|

SONMEZ FILAMENT (SONME)

Son Fiyat - 127.30₺

|

arrow_forward |

|

ALKIM KAGIT (ALKA)

Son Fiyat - 7.61₺

|

arrow_forward |

|

OFIS YEM GIDA (OFSYM)

Son Fiyat - 55.10₺

|

arrow_forward |

|

BOR SEKER (BORSK)

Son Fiyat - 24.42₺

|

arrow_forward |

|

KONYA KAGIT (KONKA)

Son Fiyat - 36.12₺

|

arrow_forward |

|

ISIKLAR ENERJI YAPI HOL. (IEYHO)

Son Fiyat - 12.94₺

|

arrow_forward |

|

ALKIM KIMYA (ALKIM)

Son Fiyat - 17.83₺

|

arrow_forward |

|

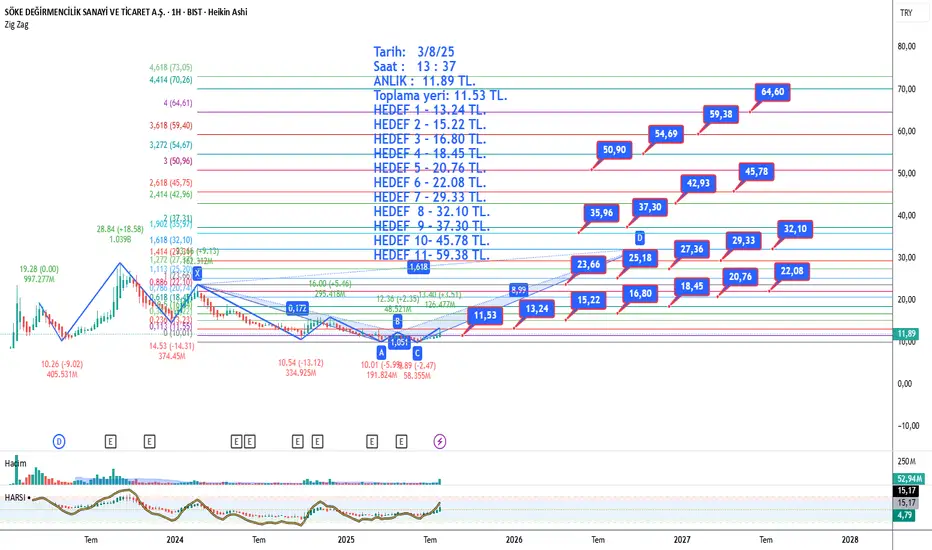

SOKE DEGIRMENCILIK (SOKE)

Son Fiyat - 11.89₺

|

arrow_forward |

|

ULUSOY UN SANAYI (ULUUN)

Son Fiyat - 7.85₺

|

arrow_forward |

|

BAREM AMBALAJ (BARMA)

Son Fiyat - 18.65₺

|

arrow_forward |

|

EKSUN GIDA (EKSUN)

Son Fiyat - 6.28₺

|

arrow_forward |

|

KAPLAMIN (KAPLM)

Son Fiyat - 210.30₺

|

arrow_forward |

|

AKIN TEKSTIL (ATEKS)

Son Fiyat - 80.50₺

|

arrow_forward |

|

ARSAN TEKSTIL (ARSAN)

Son Fiyat - 22.68₺

|

arrow_forward |

|

INNOSA TEKNOLOJI (INTEK)

Son Fiyat - 440.00₺

|

arrow_forward |

|

ISBIR SENTETIK DOKUMA (ISSEN)

Son Fiyat - 8.54₺

|

arrow_forward |

|

SANKO PAZARLAMA (SANKO)

Son Fiyat - 21.58₺

|

arrow_forward |

|

BAGFAS (BAGFS)

Son Fiyat - 39.90₺

|

arrow_forward |

|

DINAMIK ISI MAKINA YALITIM (DNISI)

Son Fiyat - 22.60₺

|

arrow_forward |

|

MERCAN KIMYA (MERCN)

Son Fiyat - 34.58₺

|

arrow_forward |

|

OTTO HOLDING (OTTO)

Son Fiyat - 497.00₺

|

arrow_forward |

|

YUNSA YUNLU (YUNSA)

Son Fiyat - 6.11₺

|

arrow_forward |

|

KUTAHYA SEKER FABRIKASI (KTSKR)

Son Fiyat - 68.65₺

|

arrow_forward |

|

ISBIR HOLDING (ISBIR)

Son Fiyat - 114.90₺

|

arrow_forward |

|

LUKS KADIFE (LUKSK)

Son Fiyat - 88.25₺

|

arrow_forward |

|

BAK AMBALAJ (BAKAB)

Son Fiyat - 37.02₺

|

arrow_forward |

|

OZSU BALIK (OZSUB)

Son Fiyat - 21.20₺

|

arrow_forward |

|

RUZY MADENCILIK VE ENERJI (ALMAD)

Son Fiyat - 7.25₺

|

arrow_forward |

|

EMINIS AMBALAJ (EMNIS)

Son Fiyat - 205.00₺

|

arrow_forward |

|

RUBENIS TEKSTIL (RUBNS)

Son Fiyat - 21.18₺

|

arrow_forward |

|

SUMAS SUNI TAHTA (SUMAS)

Son Fiyat - 318.00₺

|

arrow_forward |

|

DURAN DOGAN BASIM (DURDO)

Son Fiyat - 4.35₺

|

arrow_forward |

|

GEDIZ AMBALAJ (GEDZA)

Son Fiyat - 25.02₺

|

arrow_forward |

|

BILICI YATIRIM (BLCYT)

Son Fiyat - 20.86₺

|

arrow_forward |

|

SODAS SODYUM SANAYII (SODSN)

Son Fiyat - 102.00₺

|

arrow_forward |

|

BANTAS AMBALAJ (BNTAS)

Son Fiyat - 7.75₺

|

arrow_forward |

|

TEMAPOL POLIMER PLASTIK (TMPOL)

Son Fiyat - 83.55₺

|

arrow_forward |

|

HATAY TEKSTIL (HATEK)

Son Fiyat - 17.79₺

|

arrow_forward |

|

ACIPAYAM SELULOZ (ACSEL)

Son Fiyat - 111.00₺

|

arrow_forward |

|

KARSU TEKSTIL (KRTEK)

Son Fiyat - 26.48₺

|

arrow_forward |

|

SOKTAS (SKTAS)

Son Fiyat - 5.37₺

|

arrow_forward |

|

BERKOSAN YALITIM (BRKSN)

Son Fiyat - 7.62₺

|

arrow_forward |

|

MEGA POLIETILEN (MEGAP)

Son Fiyat - 4.80₺

|

arrow_forward |

|

OZERDEN AMBALAJ (OZRDN)

Son Fiyat - 9.08₺

|

arrow_forward |

|

SEKURO PLASTIK (SEKUR)

Son Fiyat - 16.93₺

|

arrow_forward |

|

PERGAMON DIS TICARET (PSDTC)

Son Fiyat - 128.20₺

|

arrow_forward |

|

EKIZ KIMYA (EKIZ)

Son Fiyat - 61.15₺

|

arrow_forward |

|

DIRITEKS DIRILIS TEKSTIL (DIRIT)

Son Fiyat - 26.46₺

|

arrow_forward |

|

BIRLIK MENSUCAT (BRMEN)

Son Fiyat - 8.60₺

|

arrow_forward |

|

BAHADIR KIMYA (BAHKM)

Son Fiyat - 53.35₺

|

arrow_forward |

|

RUZY MADENCILIK VE ENERJI (RUZYE)

Son Fiyat - 8.38₺

|

arrow_forward |

Hisse Sinyalleri

Hisse Sinyalleri